The Role of Compliance Markets in Reaching Net-Zero

Last month, the Conference of the Parties of the UNFCCC, more commonly referred to as COP27, took place in Sharm El Sheikh, Egypt. World leaders met for two weeks of climate negotiations and reaffirmed their commitment to the Paris Agreement goal to limit global warming to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels.

Unfortunately, a UN report released shortly before COP27 states that the climate pledges of 193 parties under the Paris Agreement could put the world on track for around 2.5°C of warming by the end of the century.

Recognizing the need for greater climate action, the published draft of decisions from COP27 emphasized “the urgent need for immediate, deep, rapid and sustained reductions in global greenhouse gas emissions” in order to achieve the 1.5°C goal.

One of the most efficient ways for governments to reduce greenhouse gas (GHG) emissions and drive innovation in decarbonization technologies is carbon pricing. At COP27, Canada and Chile announced the Global Carbon Pricing Challenge to encourage countries to adopt carbon pricing[i].

Currently about 20% of global GHG emissions are covered by carbon pricing[ii] and the goal of the Global Carbon Pricing Challenge is to cover 60% of global emissions by 2030.

Carbon pricing puts a cost on emissions to incentivize emitters to shift away from high-emissions activities and products to low-carbon or no-carbon alternatives. Governments can implement carbon pricing with a carbon tax on fossil fuels or establish an emissions trading system (ETS).

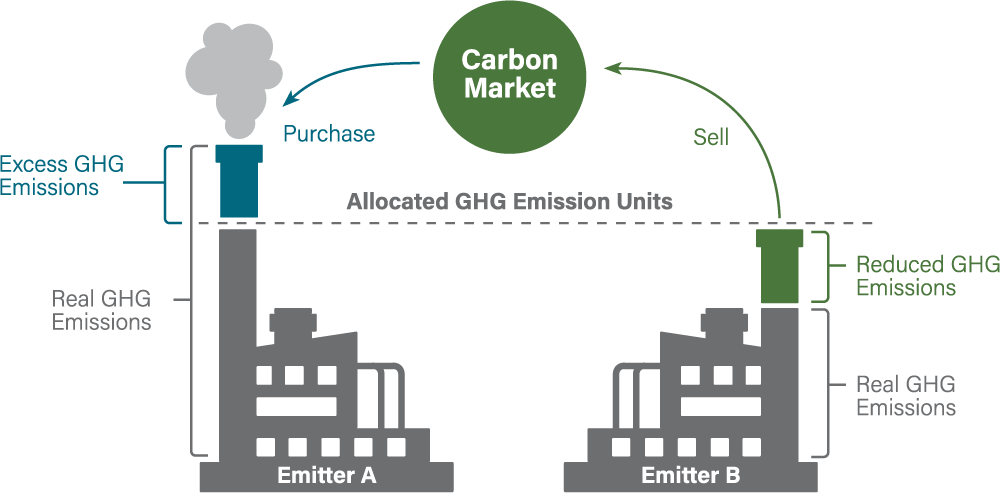

An ETS, also sometimes referred to as a cap-and-trade program, is a system where regional, national or subnational jurisdictions set a cap on the total annual GHG emissions to be generated by specific industries. Carbon allowances, also known as emission allowances, equal to the cap are then freely allocated and/or auctioned to regulated companies. Companies within an ETS buy or sell carbon allowances based on need. Emitters with insufficient allowances to offset their emissions at the end of the reporting period incur penalties.

How an Emissions Trading System Works

In an ETS, the number of new allowances is reduced each year so that climate goals are met. The supply and demand for these allowances establishes a market-based price for emissions. When the price of carbon allowances is sufficiently high, companies have an incentive to invest in lower-cost clean energy alternatives.

The ETSs established by various jurisdictions collectively form the compliance carbon markets. The transaction value of the global compliance markets has grown from €186 billion ($220 billion) in 2018 to €760 billion ($899 billion) in 2021, a compound annual growth rate (CAGR) of around 60%[iii].

While companies and other registered entities in an ETS can buy or sell carbon allowances for that particular ETS, most investors do not have access to directly buy and sell carbon allowances. However, there are active futures markets that provide investors with exposure to certain ETSs.

A futures contract is a legal obligation to purchase or sell an underlying asset for a specified price at some date in the future. Carbon allowance futures contracts allow for the trading of the underlying carbon allowances of specific ETSs.

While an investor can purchase carbon allowance futures contracts, it may be difficult for some investors to gain access to derivative markets. A more accessible option may be an exchange-traded fund (ETF) that invests in a portfolio of carbon allowance futures.

Carbon Streaming has a 50% equity interest in Carbon Fund Advisors Inc., the sub-advisor of the Carbon Strategy ETF (NYSE: KARB), an actively managed ETF that invests in carbon allowance futures contracts which currently includes future contracts on the following underlying allowances:

- European Union Allowances (EUA);

- California Carbon Allowances (CCA); and

- Regional Greenhouse Gas Initiative (RGGI) CO2 Allowances.

The EU ETS was the world’s first ETS and remains the largest by trading volume and value today. In the United States, there is the California cap-and-trade program and RGGI, a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont and Virginia to cap and reduce emissions from the power sector.

The Carbon Strategy ETF aims to provide exposure to the compliance carbon markets and potential appreciation in carbon prices due to tightening environmental regulation and reductions in the supply of allowances as the world aims to achieve the goals of the Paris Agreement.

You can find more information on the Carbon Strategy ETF at its website.

Stay up to date with the latest Carbon Streaming news and new Carbon Blog posts by signing up to our email list and following us on Twitter and LinkedIn.

[i] Environment and Climate Change Canada, News Release, November 15, 2022

[ii] The World Bank, Carbon Pricing Dashboard

[iii] Refinitiv, Carbon Market Year in Review 2021, 1/31/22. (2018: $1 = 0.847 euros and 2021: $1 = 0.845 euros)

Forward-Looking Information: Some of the posted entries on the Carbon Blog may contain forward-looking information. Forward-looking information address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. For further information about the risks, uncertainties and assumptions related to such forward looking information we refer you to our legal notice.