Why Companies Participate in Voluntary Carbon Credit Markets

Carbon credit markets fall into two categories: the Compliance Markets, which are sometimes referred to as the Regulated Markets, and the Voluntary Markets.

If you’re new to the sector, or would like a quick refresh, you can find a detailed overview of these markets and their differences in our previous post regarding The Dawn of the Carbon Credits Age.

The short explanation is that certain industries are regulated by emission trading systems (ETS) in their regions and are required by law to offset their emissions with carbon credits. The Compliance Markets are where the buying and selling of these credits occurs, the largest of which are run by the EU and China. The total value of the global Compliance Markets hit approximately US$261 billion in 2020i.

For everyone else, and by that we mean companies and industries not regulated by an ETS, that are working to offset their carbon emissions, you have the Voluntary Markets.

In 2019, US$320 million in transactions occurred in the Voluntary Marketsii. The following year, it is estimated that buyers retired carbon credits for some 95 million tons of carbon dioxide equivalent, which was more than twice the amount in 2017iii.

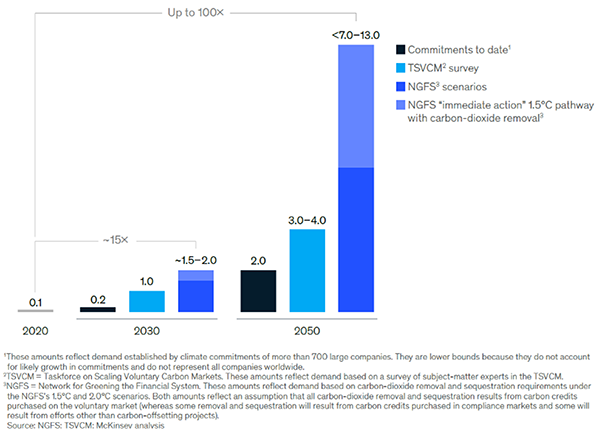

McKinsey & Company has forecasted potential growth factors of up to 15x by 2030 to give the Voluntary Markets a potential future overall value of up to US$50 billion in 2030iv. The same report predicts growth of up to 100x by 2050.

Voluntary demand scenarios for carbon credits, gigatons per year

So, what is driving such a degree of participation in the voluntary markets and, more importantly, why are people projecting such strong, continued growth?

The world is now focused on decarbonization

The United Nation’s Race to Zero Campaign is a global coalition comprising hundreds of cities, thousands of businesses and others committed to reach net-zero by 2050. Combined, members cover almost 25% of global CO2 emissions and over 50% of global GDP.

Companies are under pressure to decarbonize from governments, NGOs, consumers, regulators, shareholders and even their own employees, and this pressure comes in different forms. Let’s look, for example, at the Net Zero Asset Managers Initiative – an international group of asset managers focused on investments that align with net-zero greenhouse gas emissions by 2050 or sooner. In just nine months since launch, 128 asset management companies controlling a combined US$43 trillion in assets, have signed up. The group includes numerous heavy hitters such as BlackRock and Vanguard and is pursuing decarbonization action from corporations.

When corporations start hearing the words “act now or lose access to our money” action tends to follow soon afterwards. The number of major corporations announcing net-zero commitments by 2050 or sooner had reached almost 1,600 by 2020 – tripling in a year.v It’s clear that the corporate world has heard the message – capital will go to those that do not put off addressing climate change.

At a government level, you have numerous actions related to decarbonization, targeting industries such as transportation and energy. However, more pertinent to the voluntary carbon credit markets is the strong support for climate risk disclosure. In June, the G7 finance ministers stated that they support moving towards mandatory climate-related financial disclosures. In the U.S., the Securities and Exchange Commission (SEC) plans to release a rulemaking proposal on mandatory climate risk disclosures by the end of the year.

Efficiencies and current technologies can only take companies so far

As more and more corporations start working on their new net-zero pledges, they are quickly coming face to face with the realities of decarbonization at the company level.

The first step of the process is of course to calculate, in great detail, what your carbon footprint is. With that in place, you can then start the phases of planning and implementing changes at an operational and supply chain level to reduce, and ideally eliminate, that footprint.

However, many companies are currently unable to eliminate all of their emissions with efficiencies and technologies alone. Think, for example, of the metals needed in the EVs and energy storage required for the green energy transition. Mining, refining, construction, and other sectors with hard-to-abate emissions may require new and even next generation technologies to reduce their emissions that are not yet feasible. For all of these companies and others, the voluntary markets can play a role in reaching their net-zero goal.

Where do we go from here?

As investor and consumer awareness has begun to grow, some have expressed concern that carbon credits can represent a license to pollute. However, the reality is that purchasing carbon credits is not just a paper transaction enabling a company to claim carbon neutrality, it is the real-world transfer of money from the corporations to the front lines of climate change. The Voluntary Markets are funding projects that sequester carbon, prevent further carbon being released, and drive innovation for emerging climate technologies. And that’s not all. Many of these projects provide a wide array of additional social and environmental benefits such as biodiversity protection, public-health improvements, and job creation.

For our world to reach net-zero carbon in sufficient time, every tool and every advantage must be used. As the recent growth shows, the corporate world is quickly waking up to the value and importance of the voluntary markets – a trend we expect to continue over the coming years. If you would like to hear more about the markets, listen to our President & CEO, Justin Cochrane, talk about the industry and Carbon Streaming’s strategy.

Stay up to date with the latest Carbon Streaming news and new Carbon Blog posts by signing up to our email list and following us on Twitter and LinkedIn.

i Refinitiv “Carbon Market Year in Review 2020”

ii Ecosystem Marketplace “State of Voluntary Carbon Markets 2020 Report”

iii McKinsey & Company “A blueprint for scaling voluntary carbon markets to meet the climate challenge”

iv McKinsey & Company “A blueprint for scaling voluntary carbon markets to meet the climate challenge”

v NewClimate Institute

Forward-Looking Information: Some of the posted entries on the Carbon Blog may contain forward-looking information. Forward-looking information address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. For further information about the risks, uncertainties and assumptions related to such forward looking information we refer you to our legal notice.